Is Crypto Innovative or Insidious? How and Why Countries Are Banning Cryptocurrency

Cryptocurrency has been experiencing surges of usage and popularity in mainstream digital media in the United States. However, the digital currency exchange is being curbed by the negative reactions of national banks across the globe.

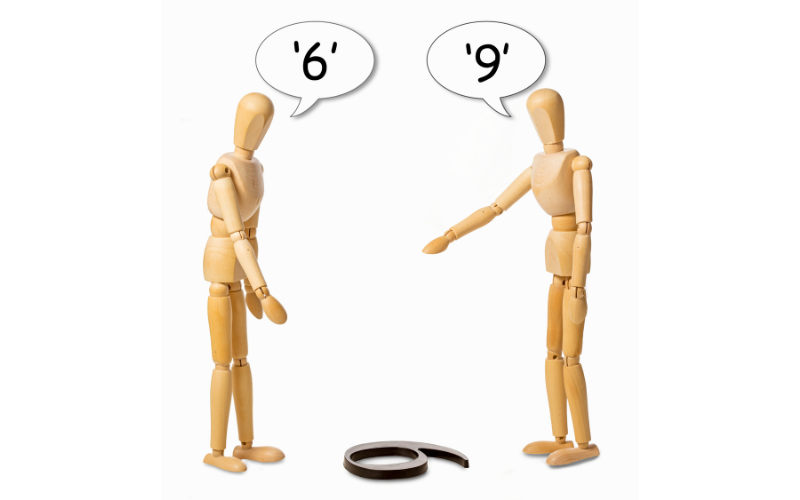

Part of the appeal of cryptocurrency usage is its independence from traditional finance infrastructure. As Bitcoin is decentralized (ie. no one nation of bank controls it, or can even influence it), it represents a threat to both governments and central banks.

It is perceived as a more secure method of transferring funds and is much faster and cheaper then using the traditonal financial institutions and the government.

However, not everyone sees that appeal: there are a few countries that aren’t quite so on board with cryptocurrency for a variety of reasons. To understand why, it is important to consider the pros and cons of using this type of currency, from the perspective of both investors and governments.

The Pros and Cons of Using Cryptocurrency Depend on Perspective

The Pros and Cons of Using Cryptocurrency Depend on Perspective

Cryptocurrency is—and was intended to be—a fully anonymous system, meaning that there is no equivalent to a receipt for transactions made.

Using cryptocurrency means that data about people’s purchases are not collected, stored, or reused by third parties—including banks and the government. As a result, consumers can engage in a variety of financial activities while maintaining their privacy. For consumers, this is good. For companies that make their money by buying, selling, and trading money or data, it is a significant threat to their business model.

The biggest downside for consumers is that cryptocurrencies are not insured by the FDIC. This means that investments in cryptocurrency through an exchange or intermediary may be significantly less secure. Market conditions can change at the drop of a hat, and the exchanges and intermediaries that trade and offer digital currencies do not have the same protections as traditional banks. Unexpected changes could lead to sudden halts on transfers or withdrawals, and the consumer would have no recourse. This is why almost all holders of Bitcoin, or other cryptocurrencies, do NOT hold or store their tokens on the exchange. They transfer them right away to a secure “digital wallet’, which only they (and perhaps a family member or two) have access to. Once this is done, the cryptocurrencies are actually safer and less prone to theft or interruption than a traditional bank account, or credit card, or brokerage account, which can be, and are, hacked regularly.

Additionally, the lack of surveillance and protection is the same reason for the proliferation of cryptocurrency usage in illegal online marketplaces and fraud. Without the restrictions and regulations of cash-and-coin banking systems, large amounts of money can be traded much more easily without being flagged or seized. Indeed, many governmental or global financial entities, such as the IMF, World Bank, and central banks claim that Bitcoin and other altcoins are used for “black markets” activities, such as gun and human trafficking and illicit drug trading-and indeed they are. However, the “authorities” claim rings quite hollow, as the US dollar remains the leading tool around the world for drugs, guns, human trafficking, and all other nefarious activities.

The Reaction to Cryptocurrency

The Reaction to Cryptocurrency

With these more problematic aspects of cryptocurrency in mind, nine countries currently have an absolute ban on the use and ownership of cryptocurrency, and an additional 42 countries currently have implicit bans in place, a statistic that has doubled since 2018. Now, with talk of Russia adding their name to that list, consumers want to know how these bans are being enforced, and what that means for crypto users on a global scale.

Absolute vs. Implicit Bans

An absolute ban, as adopted by Algeria, Bangladesh, China, Egypt, Iraq, Morocco, Nepal, Qatar, and Tunisia, prevents all individuals and financial institutions from owning or dealing in cryptocurrencies in any way. Any operation that involves the transfer or holding of a digital currency is considered a criminal activity and could result in a person’s imprisonment.

An implicit ban, on the other hand, means that governments restrict financial institutions from acquiring cryptocurrency users or owners as their clients. Additionally, these institutions may not offer their services to someone known to have any dealings in cryptocurrencies.

The Effect of Crypto Bans

The hope of legislation like this is to create restrictions around the usage of cryptocurrency. That would reduce its usage in criminal activities such as money laundering or drug trafficking. Ultimately, the goal is to reduce the overall usage of cryptocurrency, leading to a decrease in crypto mining.

This effect was seen immediately after China’s ban on cryptocurrency, which led to an 8 percent fall for Bitcoin on the same day as the legislature was passed. However, within a few weeks of the ban, Bitcoin bounced back to numbers even greater than it had been previously—despite the fact that China had been one of the largest markets for cryptocurrencies prior to that point.

Nations embracing Bitcoin and cryptos

At the same time, several nations have embraced Bitcoin and are looking to expand its use. The small nation of El Salvador officially adopted Bitcoin as an accepted currency and legal tender alongside the US dollar as of September 7, 2021. Other nations that have expressed interest in adding or adopting Bitcoin or other cryptos are Switzerland, Cuba, Panama, Paraguay, Uruguay, Brazil, Ukraine, and Germany. Additionally, four US states have granted commercial status to Bitcoin-Wyoming, Nebraska, Rhode Island, and Texas. Bitcoin entrepreneurs are flocking to Texas and El Salvador (who is building a Bitcoin City shortly).

Crypto Mining and Potential Future Bans

Crypto Mining and Potential Future Bans

The environmental impact of crypto mining has received negative attention from the media recently. Notable innovators such as Elon Musk spoke out about the state of our climate, and the impact of crypto mining. The process of crypto mining utilizes an extremely large amount of energy. Unfortunately, it is also the most popular method for large companies like Bitcoin and Ethereum to create new crypto coins.

The energy usage of these processes is staggering, with numbers sometimes exceeding that of the usage of entire countries. Renewable energy sources are used by some companies such as Bitcoin. However, green sources of power only make up around 39 percent of the total energy used for crypto mining as a whole.

Critics of cryptocurrencies’ use of electricity, however, usually fail to point out that video gamers use even more electricity globally, and that almost none of that power is from renewables, so that argument is also increasingly specious. We must remember what a threat Bitcoin is to the establishment as we read negative articles about it or cryptos in general.

While places like China are implementing laws to remove these mining centers from their country, it is not eradicating the process entirely, especially since the United States currently makes up 35 percent of all Bitcoin mining worldwide. While reducing numbers for individual countries, it seems that the bans countries are implementing are not making a dramatic difference on a global scale.

The Outlook on Cryptocurrency

Whether inspired by the move towards eradication of cryptocurrencies by other governments, or as a call to reduce the harmful environmental impacts of crypto mining, more and more countries are creating legislatures to put restrictions around crypto usage.

With some countries even creating their own digital currencies produced and monitored by their central banks, statisticians are expecting more countries to move toward the banning of cryptocurrencies in some fashion in 2022.

Again, at the same time, some analysts and economists expect the number of countries using and/or embracing digital currencies to grow this year and in the near future. It is a fascinating situation and makes it hard to predict what money and daily financial dealings will look like in just a few years.

Author

Robert Ryerson

Although Robert M. Ryerson completed all the necessary requirements to earn bachelor of arts degrees in both English and economics at Rutgers University, college policy at the time prohibited the issuance of dual degrees. As a result, he graduated from Rutgers with a single bachelor of arts in economics before finding employment as a stockbroker with Shearson Lehman American Express in New York City 1984. Robert M. Ryerson has since established himself as a respected estate administrator and legacy planner. In addition to his economics degree from Rutgers, Mr. Ryerson holds several professional designations including Retirement Income Certified Professional (RICP)®; Certified In Long Term Care (CLTC)®; Certified Financial Fiduciary (CFF)®, and Certified Identity Theft Risk Magenament Specialist (CITRMS)®. He has shared his knowledge on the subject of identity theft as the author of the book What’s The Deal With Identity Theft?: A Plain-English Look at Our Fastest Growing Crime. He has also covered identity theft issues directly for students as the instructor of the adult education course Understanding Identity Theft: Our Fastest Growing Crime.