In a recent educational video from New Century Planning, Bob Ryerson sat down with Alan Johnson, a leading authority on self-directed Individual Retirement Accounts (IRAs), to demystify the concept and benefits of these investment vehicles. Their discussion shed light on the opportunities self-directed IRAs offer for investors seeking to broaden their retirement portfolios beyond traditional […]

Identity theft, a multifaceted problem often misconstrued as solely a credit-related issue, is a significant concern in the digital age. Robert Ryerson and Lou Terrero, Certified Identity Theft Risk Management Specialists (CITRMS) from New Century Planning Associates, offer valuable insights into the complexity of identity theft and the crucial strategies for responding to it. Beyond […]

In today’s fast-paced world, many overlook the critical importance of estate planning, not realizing its potential to prevent financial mishaps and family disputes after one’s passing. Christina Hardman-O’Neal, Esq., in a comprehensive discussion, sheds light on why smart estate planning is indispensable for seniors, outlining the essential steps and documents required to secure their legacy […]

While online apps and programs are not usually adequate substitutes for live human financial advisors who can help you navigate the complexities of planning and saving for retirement, there are several steps you can take on your own to ensure you’re ready for a comfortable post-work life. There are many apps and online resources that […]

Taxes are always an important part of our financial lives, but can often be underestimated in retirement planning. Watch this new short video below as our series continues once again on improving your future tax outlook. Part 1 Introduction – How Your Money Really Works 0:00 – 8:55 Part 2 Beating Longevity Risk with Tax-Free […]

Have you heard about the fed now program being rolled out shortly? Over 120 financial institutions have joined in the launch of the first phase of the “Fed Now” program. The Federal Reserve issued a notice back on 8/5/19 (Docket No.—OP-1670) announcing their new interbank, real-time gross settlement service, which is intended to reduce the […]

When most of us think about planning for retirement, we’re focused on just enjoying our golden years. However, there are actually several phases that go into successful retirement planning. This guide takes a look at each of the different phases of retirement planning. Plus, we’ll break down what steps to take at each phase of […]

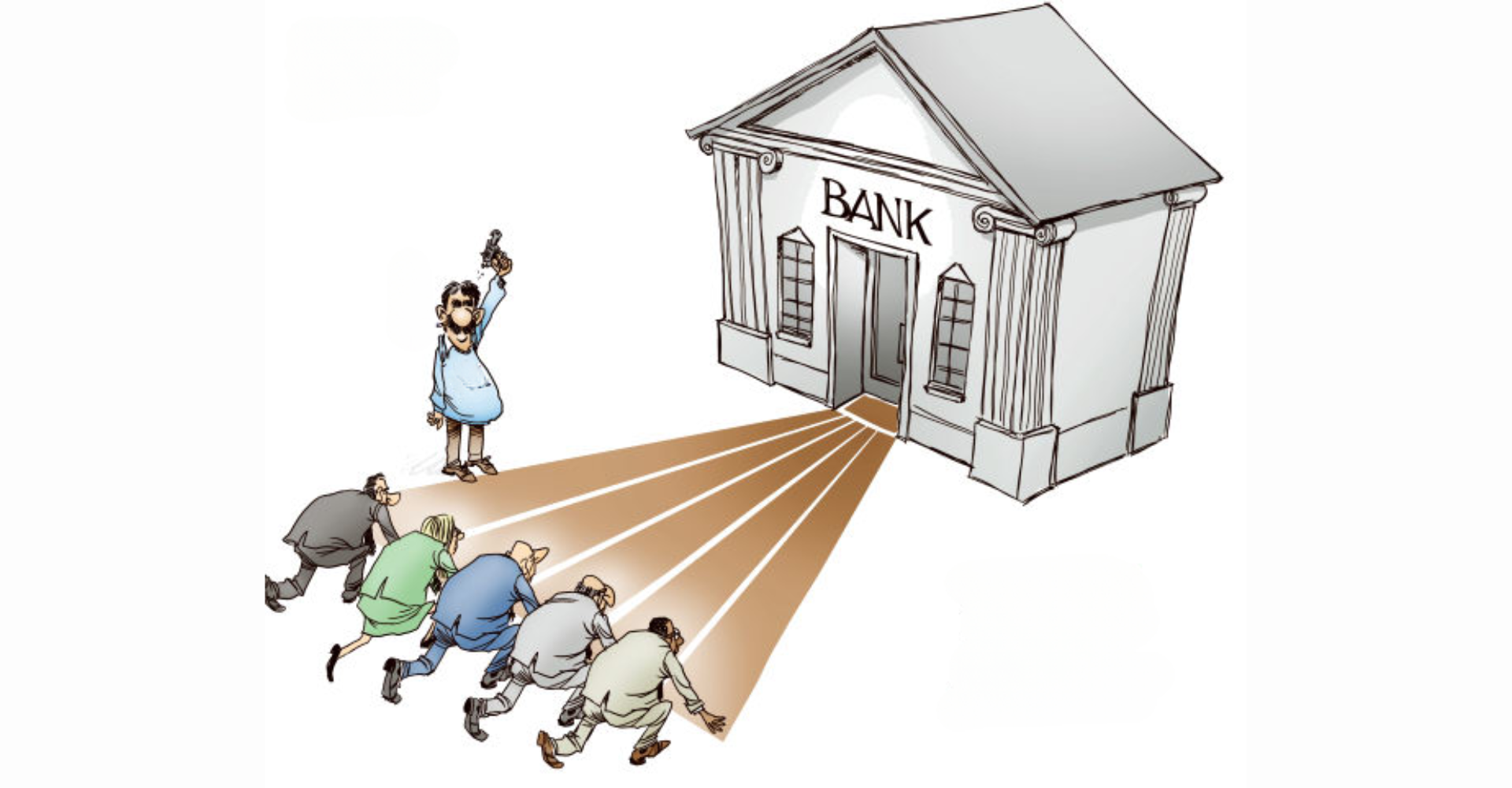

Sunday, 04/23/2023, 10 pm A few weeks ago (March 10th and 12th) The US saw its second and third largest bank failures in history (Silicon Valley Bank-$209B, and Signature Bank-$110B), and recently the treasury secretary said that all was well, and that the economy is doing well. The depositors at these two banks who had […]

Many people know that investing in cryptocurrency can be a way to build wealth and start increasing their potential future income. However, not as many people think about the benefits of investing in cryptocurrency in order to save for retirement. This guide goes over different ways that individuals can invest in cryptocurrencies in order to […]

Once a radical idea, the thought of investing in cryptocurrency has taken off in recent years. In fact, research suggests that around 21% of American adults have invested in or purchased cryptocurrency at some point. Although Bitcoin is by far the most well-known and popular cryptocurrency, there are actually a number of different digital coins […]