Retirement planning covers a variety of different areas, from 401(k) plans to estate planning. Navigating this complex area on your own can be a challenge, so it is beneficial to seek out the services of an experienced financial planner, particularly one who is knowledgeable about retirement. One aspect of retirement planning that is sometimes overlooked […]

When people consider their finances, the most common things they focus on are saving for retirement, maximizing their current finances, saving for major purchases, and paying down debt. But there is an additional area of financial planning that tends to be overlooked: post-retirement financial planning. Many people see retirement planning as a process that ends […]

When it comes to retirement, most Americans today have some form of defined-contribution plan for their retirement, typically through their employer. The most popular retirement plan today is probably a traditional 401(k) plan. Self-employed Americans, on the other hand, don’t have an employer to sponsor a retirement plan for them. In some cases, they may […]

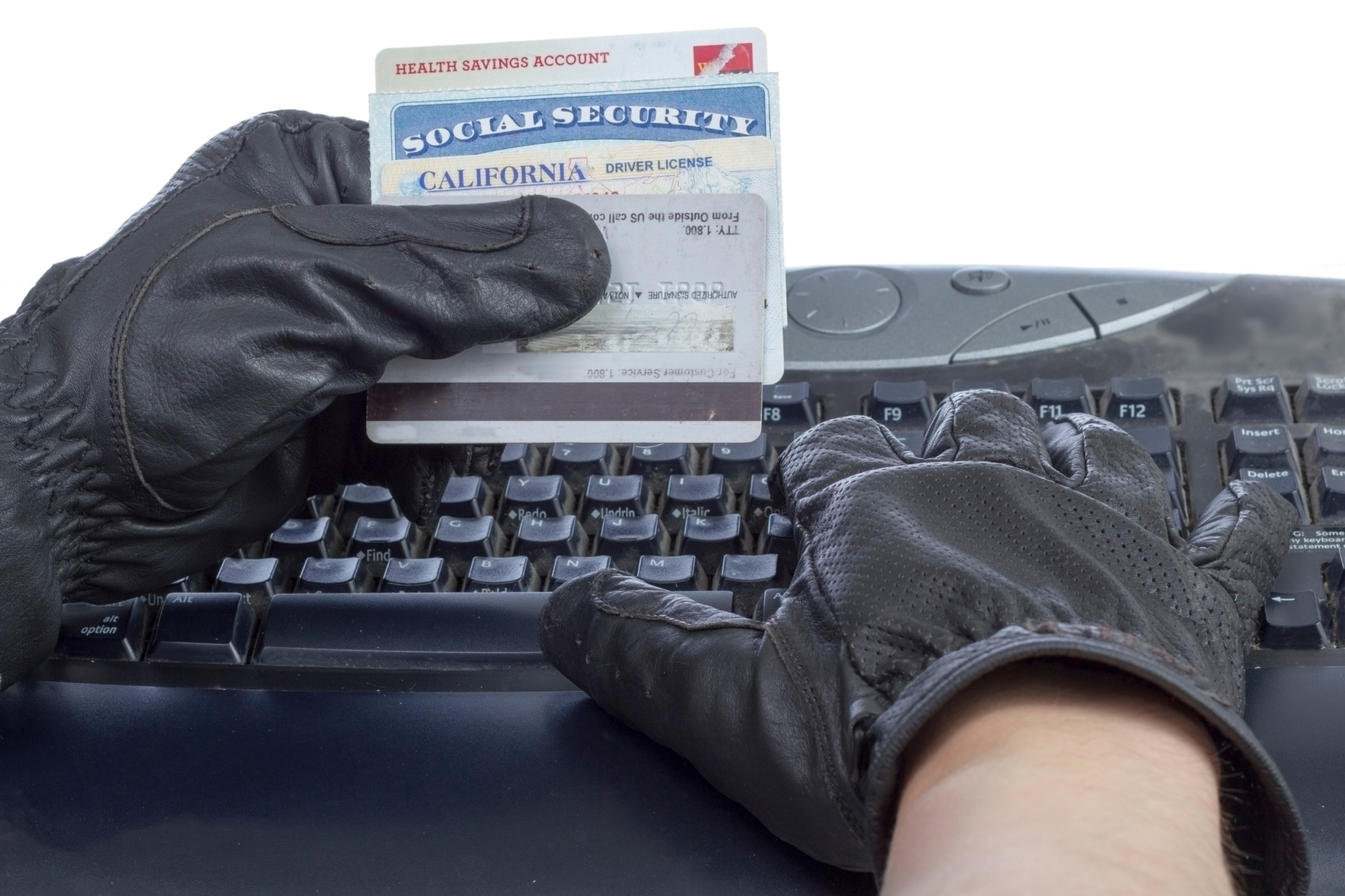

Robert M. Ryerson serves as a Certified Financial Planner with New Century Planning in Freehold, New Jersey. He has additionally earned certification from the nonprofit Institute of Consumer Financial Education as a Certified Identity Theft Risk Management Specialist. Robert M. Ryerson book What’s the Deal with Identity Theft? appeared in 2016. In the book, he gives […]

Robert M. Ryerson serves as a Certified Financial Planner with New Century Planning in Freehold, New Jersey. He has additionally earned certification from the nonprofit Institute of Consumer Financial Education as a Certified Identity Theft Risk Management Specialist. Robert M. Ryerson book What’s the Deal with Identity Theft? appeared in 2016. In the book, he gives […]