As 2022 draws to a close, now is the time to start considering what financial moves you will want to make before the end of the year and the start of 2023. This aspect of financial planning is sometimes known as ‘year-end’ planning, and it is a common undertaking when considering your long-term finances. During […]

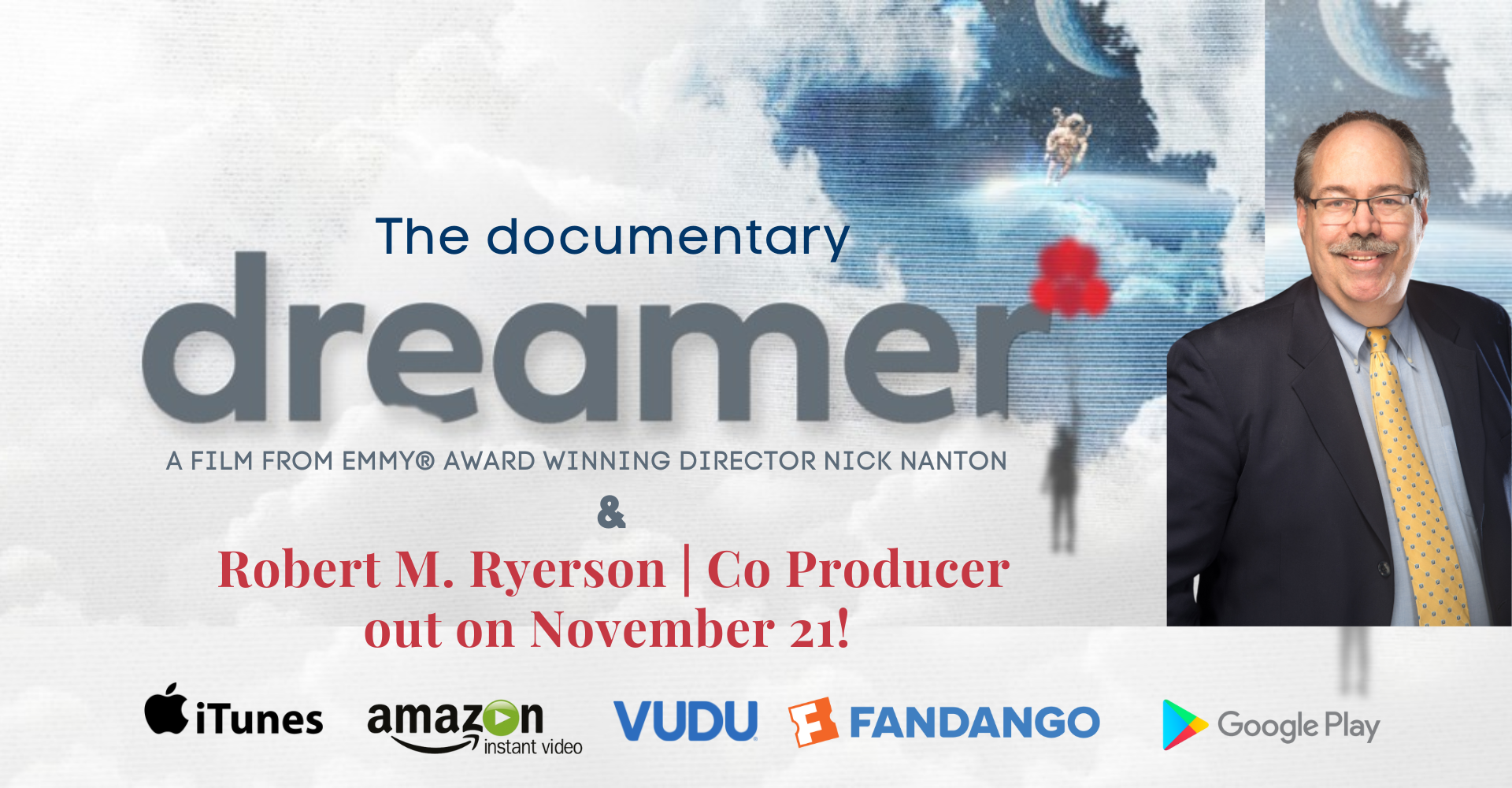

“I am honored and excited to be able to be a co-producer of this inspiring documentary about entrepreneurs who embraced their dreams instead of just having their heads in the clouds!” Robert M. Ryerson Contact us – start your planning now!

Note: I cannot guarantee the accuracy of any of any of these quotes or articles or projections—these are just recent subjects and events and questions and rumors that have piqued my interest, and got me to musing and wondering…. *️⃣ Will the Fed “capitulate” and stop raising rates in a few months because they have […]

As 2022 draws to a close, now is the time to start considering what financial moves you will want to make before the end of the year and the start of 2023. This aspect of financial planning is sometimes known as ‘year-end’ planning, and it is a common undertaking when considering your long-term finances. During […]

Many people don’t start saving for retirement until it’s too late. And, a lot of the time, that’s because they don’t know the first thing about finding a good retirement plan. To make sure you don’t fall into that trap, it’s a good idea to educate yourself on the different plans available to you. Here […]

Note: I cannot guarantee the accuracy of any of any of these quotes or articles or projections—these are just recent subjects and events and questions and rumors that have piqued my interest, and got me to musing and wondering…. *️⃣ Will the Fed “capitulate” and stop raising rates in a few months because they have […]

(Passing digital assets to heirs can be unnecessarily complicated and time consuming unless you do some of the legwork upfront) Not long ago, digital assets played virtually no role in estate planning. Today, however, leaving an electronic mess can be one of the most costly mistakes in the process. Failing to account for digital assets […]

In this increasingly online world, people do not look at their digital assets in the same way they do their physical assets. However, everything from domain names to social media accounts can be considered assets. As you undertake the process of estate planning, you should be sure to include your digital assets. Making a list of […]

Identity theft, which involves stealing another individual’s personal information, has become an increasingly pervasive problem in recent years due in part to advances in technology. There are now more ways than ever for scammers to acquire someone’s credit card, passport, or other documents containing personal information. Identity fraud occurs when the scammer uses this information […]

When you are in the prime of your life, retirement may seem like a long way off in the future. Maybe this perception is the reason why 60 percent of Americans haven’t determined how much they’ll need for retirement. However, if you want to enjoy a financially secure retirement, now is the best time to […]

- 1

- 2