This blog is intended to educate, enlighten, amuse and ( hopefully) persuade. It is not my intention to annoy, or insult or provoke the reader. However, in the current hyper-sensitive political and economic environment, I am pretty sure that some of my posts, or my guest bloggers’ posts, will rub readers the wrong way. My overall intention is to try to have the reader look at current economic and/or geopolitical things in the news in more depth, and think about the potential implications…

Prepare Financially This Fall: Smart Habits for Year-End

As we draw closer to the holiday season, it's natural to feel anxious about finances, but this time of year offers a perfect opportunity for financial reflection and planning. Embrace a proactive...

Read more

What Is Life Insurance, Really? A Simple Guide

Understanding Life InsuranceMany people grapple with understanding life insurance, and you're not alone. According to a 2024 J.D. Power study, only 29% of life insurance customers feel their...

Read more

4 Essential Financial Moves to Complete Before Year-End

As the year comes to a close, it's an ideal time to seize control of your financial planning. We understand that financial to-dos can sometimes feel overwhelming, but it’s empowering to take...

Read more

100 Days Left: Optimize Your 401(k) Strategy Now

Embrace the 100-Day CountdownThe vibrant hues of fall signal more than just a change in season; they mark a critical 100-day countdown to close the year. For many of us, it's the last chance to...

Read more

Avoid These Costly Year-End Tax Surprises

Every year, business owners find themselves caught off guard by unexpected tax issues that can derail their carefully laid plans. As the year progresses, tax season looms closer, and it's all too...

Read more

Tax Implications of Major Life Changes

Life changes, whether joyous or challenging, often come with emotional and practical adjustments. Marriage, divorce, or expanding your family are milestones that bring both excitement and...

Read more

Auto-Enrollment & Auto-Escalation: Boost Participation & Compliance

Meeting Challenges With Smart SolutionsFor employers and HR professionals managing retirement plans, the twin goals of enhancing employee outcomes while meeting legislative mandates can be daunting...

Read more

Life Insurance Awareness Month: Secure Your Financial Future

September marks Life Insurance Awareness Month, a timely opportunity for individuals to reassess their financial plans. It's natural to have both emotional and practical concerns about life...

Read more

Major Types of Investment Vehicles: An Overview

Investing can be overwhelming, particularly with the myriad of options available. Each investor carries unique needs and preferences, striving to balance risk, reward, and flexibility. Education...

Read more

Understanding the Psychology Behind Underinsurance

We've all been there—you know you should buy life insurance, yet something always stops you from taking that last step. It's a common experience, and you're not alone in feeling this way. Maybe it...

Read more

Managing Hardship Withdrawals: What Employers Need to Know

Navigating Economic Uncertainty with Empathy and Clarity In today's landscape, many employers are navigating the complexities of employee benefits amid economic uncertainty. As financial stress...

Read more

Mid-Year Financial Check-In: Navigating Life Changes

As we find ourselves midway through 2025, it's remarkable how quickly the year is flying by. With the hustle and bustle of daily life, it’s easy to overlook the financial impact of major life...

Read more

Navigating Payroll Taxes for Summer Interns

Understanding the Value of Summer InternsAs a small business owner or manager, you might find summers to be the perfect time to bring on some additional help. Interns can bring fresh perspectives,...

Read more

Decoding Economic Jargon: 5 Key Terms You Need to Know

With economic news bombarding us every day, it can often feel like you're trying to understand a new language. Yet, being informed about market updates and policy discussions is crucial for making...

Read more

Make 401(k)s Appealing to Younger Workers

Engaging Younger Employees in Retirement SavingsYounger employees, such as millennials and Gen Z, often hesitate to prioritize retirement savings. However, a well-structured 401(k) can...

Read more

Back-to-School Financial Planning Tips for Success

Embracing the Back-to-School Financial Shift As the back-to-school season kicks into gear, families find themselves adjusting to changing routines and financial landscapes. Whether dealing with...

Read more

Smart Moves to Reduce Your 2025 Business Tax Bill

As the summer sun gives us a chance to slow down and enjoy the season, it also provides a perfect opportunity to focus on your business's financial strategy. Although tax season might seem far in...

Read more

The One Big Beautiful Bill Act: A Game-Changer for Your Finances

Understanding the One Big Beautiful Bill Act The "One Big, Beautiful Bill Act" (OBBBA) is not merely a political soundbite—it's a substantial legislative package with lasting implications for...

Read more

Beyond the Basics: Life Insurance's Hidden Benefits

Rethinking Life Insurance: More Than a Safety NetMany view life insurance simply as a safety net for their loved ones after they pass away. However, there are valuable benefits to be gained during...

Read more

Protecting Your Estate from the Possibility of Cognitive Decline

A solid estate plan accounts for the full range of possibilities to create contingencies that will keep the property protected in virtually any situation. This includes the possibility of cognitive...

Read more

How a Home Equity Line of Credit Can Benefit Retirees

Saving for retirement involves a lot of planning and hard work. Often, people strive to pay off all of their debt before they retire, so the thought of taking on new debt in retirement can be...

Read more

Understanding Non-Fungible Tokens (NFTs) Explained in Plain English: Introduction and Practical Uses

In a groundbreaking discussion, New Century Planning Associates’ Robert Ryerson and Louis Terrero demystify the concept of Non-Fungible Tokens (NFTs) in their video, “A Plain English Introduction...

Read more

Investments with Self-Directed IRAs: Insights from Industry Experts

In a recent educational video from New Century Planning, Bob Ryerson sat down with Alan Johnson, a leading authority on self-directed Individual Retirement Accounts (IRAs), to demystify the concept...

Read more

Exciting Events Coming Soon!

🌟 We’re hard at work planning new events to empower you with the best financial strategies! Stay tuned for updates on upcoming workshops and seminars tailored for the vibrant community around New...

Read more

Understanding and Combating the Six Major Types of Identity Theft

Identity theft, a multifaceted problem often misconstrued as solely a credit-related issue, is a significant concern in the digital age. Robert Ryerson and Lou Terrero, Certified Identity Theft...

Read more

Smart Estate Planning for Seniors: Essential Insights from Christina Hardman-O’Neal, Esq.

In today’s fast-paced world, many overlook the critical importance of estate planning, not realizing its potential to prevent financial mishaps and family disputes after one’s passing. Christina...

Read more

From New Jersey to Ecuador – A Financial Advisors thoughts on Ecuador vs USA

A podcast discussion featuring Jesse Bayer from @AbundantLivingEcuador, delivering valuable insights for expatriates living in the region. Please feel free to share 📢 this video, For more info at...

Read more

New Century Planning Delivers Crucial Insights on US 2024 Economic Outlook for Latin American Expats

New Century Planning, a leading advisory firm catering to expatriates in Latin America, recently shared vital perspectives on the US economic landscape for 2024. The presentation highlighted...

Read more

A Plain English Introduction to NFTs – with Robert Ryerson and Louis Terrero

✴️ What Are NFTs and Why Do I Need to Learn About Them❓ ✴️ NFTs Are Not Just Overpriced Ape Images❗ ✴️ 1️⃣0️⃣ Practical Uses for NFTs 7:45 – finish Please feel free to share 📢 this video, For more...

Read more

BITCOIN BLASTOFF? (21-1-2024)

( Why it is still possible to earn huge returns in Bitcoin) On January 3rd, 2024, Bitcoin turned 15. The original Bitcoin white paper was published on 10/31/08. Bitcoin started at less than a penny...

Read more

5 Apps That Can Help You Plan and Save for Retirement

While online apps and programs are not usually adequate substitutes for live human financial advisors who can help you navigate the complexities of planning and saving for retirement, there are...

Read more

A Plain English Look at Property Taxes – What You Need to Know With Tom Mancuso, CTA

1️⃣ A Certified Tax Assessor Explains All of the Following in Plain English… 2️⃣ Is There Really an Exit Tax in New Jersey❓ 3️⃣ Why are Property Taxes So High❓ 4️⃣ What Are Property Taxes Really...

Read more

Don’t avoid learning about Cryptos – A Plain English Primer, with Jon Moore aka Jonny Litecoin

Part 1 An Introduction to Cryptos and Blockchain Technology 0:00 – 12:15 Part 2 How to Buy Cryptocurrencies and Use a Digital Wallet 12:17 – 14:57 Part 3 Can the Government Stop Bitcoin? 14:57 – 16...

Read more

The Benefits of Using Self Directed IRAs – with Alan Johnson

What Are Self-Directed IRAs (SDI)? Why it is So Important to Hold Some Non-Traditional Investments in Your IRAs You Can Own Real Estate, Portfolios of Fine Art, Precious Metals, Private Equity,...

Read more

10 Things Divorced People Must Do! With Michele Crupi, Esq.

Part 1 Financial Planning Basics for Divorced People Part 2 Here’s the 10 Things! Please feel free to share 📢 this video, For more info at www.newcenturyplanning.com, and please contact us by...

Read more

A Plain English Look at Reverse Mortgages – A Surprisingly Flexible Retirement Planning Tool

Featuring Donna Kutchta and Jennifer Fletcher of Amboy Bank – Experienced Reverse Mortgage Specialists Debunking the Myths and Misconceptions About Reverse Mortgages – from Giving Yourself Some Tax...

Read more

BE CAREFUL! The Skinny on Inherited IRAs

Inherited IRAs of All Kinds Can Be Complicated – Significant Recent Rule Changes Demand That You Watch This Primer! Please feel free to share 📢 this video, For more info at www.newcenturyplanning...

Read more

How to Avoid the 6 Major Types of Identity Theft!

Monitoring and Shredding Won’t Do the Trick We All Have Too Much Information Out in the Cloud These Days None of Us Can Prevent Breaches Occurring At Entities Out of Our Control Restoration is the...

Read more

Is Your Estate Plan in Order? Smart Steps to Take Now! With Christina Hardman-O’Neal, Esq.

Part 1 Don’t Be Afraid of Estate Planning – An Introduction. Why We All Need Power of Attorney Documents – A True Example of What Could Happen! Part 2 Leaving Money to a Disabled or Troubled Child?...

Read more

A Powerful IRA Strategy You’re Not Using – the QLAC!

This Little-Known Retirement Planning Tool Can Save You Taxes and Give You Guaranteed Inflation Protection! Please feel free to share 📢 this video, For more info at www.newcenturyplanning.com, and...

Read more

People Don’t Want to Talk About This ….. But They Really Need To!

Learn the Do’s and Don’ts About Long Term Care! The Non-Financial Consequences Can Be Even Worse! Solving the Problem Without Going Broke – How to Keep the Money in the Family if You End Up Not...

Read more

What’s New in the Retirement Plans Arena? With Charles Rosenberg, Certified Retirement Admin.

The Best Way to Use Your 401(k) or ERISA Plan – a Discussion With a Certified Retirement Counselor and Pension Expert – Charles Presents Information and Tips on How to Maximize All Retirement Plans...

Read more

The New Rules About RMDs – Some Good News! Here’s What You Need to Know!

Do You Really Understand the Required Minimum Distributions? What About Roth IRAs? What Happens If You Have Two or More Old 401(k)s? DON’T MAKE THIS MISTAKE! What Happens When You Leave Your IRA to...

Read more

A Plain English Look at Medicare – What You Need to Know – With Peter Hegel

A Plain English Intro to Medicare and Medicare Supplements 0:00-5:33 The Pros and Cons of Medicare Advantage Plans—what you MUST know! 5:33-8:59 How Medicare Supplement Policies work—and which are...

Read more

How to Use the New Life Insurance Policies as A Retirement Planning Tool

Part 1: Introduction and Use for Long-Term Care 0:00 – 6:57 Part 2: For Tax-Free Income 7:19 – 11:18 Part 3: Your Own Tax-Free Opportunity Fund! 16:12 – 18:44 Part 4: A Unique Tool – If You Can Get...

Read more

The 6 Things You Must Know About Your Social Security!

A Plain English Primer… How Your Social Security Can Be Taxed Each Year}What Is provisional Income? When to Take Your Benefits – It’s Not So Simple! 90% of Retirees Do Not Maximize Their Benefits...

Read more

5 Reasons Why You Need To Do Roth Conversions Now!

Why Roth Conversions Are Our Most Powerful Planning Tool How Roth Conversions Are So Much Bigger and Better Than Roth Contributions! Part 1 – A Plain English Intro to Roth Conversions 0:00 – 6:15...

Read more

Introduction to Crypto Currencies

Please feel free to share this video, and visit our website for more info at www.newcenturyplanning.com, and please contact us by phone +1 732-702-2777 or email info@newcenturyplanning.com. If you...

Read more

CLTC Designation

To find out why it’s important your financial advisor has a CLTC Designation, click →→→→ Contact us – start your planning now!The post CLTC Designation first appeared on New Century Planning.The...

Read more

“New Century provides the public with much needed information on how to build your fiscal house for retirement!

Contact us – start your planning now!The post “New Century provides the public with much needed information on how to build your fiscal house for retirement! first appeared on New Century Planning...

Read more

How to Create Lifelong Tax-Free Income Streams with Best Selling Author David McKnight

Taxes are always an important part of our financial lives, but can often be underestimated in retirement planning. Watch this new short video below as our series continues once again on improving...

Read more

Complimentary Dinner Seminars – Tuesday, August 29th & Thursday, August 31st, 2023 at the Colts Neck Inn NJ – By Invitation Only❗

Important Educational Topics we’ll discuss: ✓How to survive a lost decade or market crash. ✓ Market Volatility – Strategies to help protect your assets from a prolonged market downturn. ✓ Never Run...

Read more

NCP Wine Bottling🍷 Event 2023

NCP Wine Bottling Event 2023 Rough Cut New Century Planning’s Second Annual Wine Bottling Event Please feel free to share 📢 this video, and visit our website for more info at www...

Read more

Thoughts, Concerns, And Speculations – Halfway Through 2023

Have you heard about the fed now program being rolled out shortly? Over 120 financial institutions have joined in the launch of the first phase of the “Fed Now” program. The Federal Reserve issued...

Read more

Don’t Let Inflation Ruin Your Retirement

The U.S.A. has over $32 trillion of debt, and it is rising rapidly. Historically this leads to inflation and a loss of buying power over time. Our “Protecting Your Purchasing Power” series...

Read more

Why We All Need to Add Silver and Gold to Our Portfolios – With Guest Andy Schectman

Part 1 The Current State of Affairs in the Gold and Silver Markets 0:00 – 11:47 Part 2 The Big Money Knows What Is Coming! The Public Is Still Asleep! 11:51 – 18:07 Part 3 Why You Must Own Physical...

Read more

The 5 Essential Pillars of Retirement Planning

Our Basic Retirement Planning Concepts Series. Here’s a great new educational video about a key retirement planning topic – The 5 Essential Pillars: Social Security – What Our Classes Are Like – An...

Read more

SOFA Morning Workshop Introduction

Hello! Our Basic Retirement Planning Concepts Series. Here’s a great new educational video about a key retirement planning topic: The 5 Essential Pillars Social Security What Our Classes Are Like...

Read more

By Invitation Only❗ – July 26 & 27, 2023 – Dinner Presentation at 618 Restaurant

Important Educational Topics we’ll discuss: ✓How to survive a lost decade or market crash. ✓ Market Volatility – Strategies to help protect your assets from a prolonged market downturn. ✓ Never Run...

Read more

A Guide to the Stages of Retirement Planning

When most of us think about planning for retirement, we’re focused on just enjoying our golden years. However, there are actually several phases that go into successful retirement planning. This...

Read more

🎶Banks On the Run🎶(A Run on The Banks?)🎶

Sunday, 04/23/2023, 10 pm A few weeks ago (March 10th and 12th) The US saw its second and third largest bank failures in history (Silicon Valley Bank-$209B, and Signature Bank-$110B), and recently...

Read more

How to Use Crypto Investments to Save for Retirement

Many people know that investing in cryptocurrency can be a way to build wealth and start increasing their potential future income. However, not as many people think about the benefits of investing...

Read more

Always Wanted to Retire and Own Some Land?

Income Producing Organic Cacao Farm and New Home Everyone’s dream: Owning a piece of land and living in the peace and quiet of the countryside, while having a cash crop producing extra income for...

Read more

A Guide to New Cryptocurrencies

Once a radical idea, the thought of investing in cryptocurrency has taken off in recent years. In fact, research suggests that around 21% of American adults have invested in or purchased...

Read more

How inflation impacts your retirement strategy?

New Century Planning’s President Robert M. Ryerson is interviewed about how inflation impacts your retirement strategy. Contact us – start your planning now!The post How inflation impacts your...

Read more

How Do I Invest in Digital Assets? The Difference between Cryptocurrency and NFTs

NFTs and Cryptocurrencies are two popular investment categories that have been in the news increasingly in recent years. In many cases, you’ll hear these terms used interchangeably. However, they...

Read more

How Your Taxes Will Change in 2023-A Plain English Look at the Secure Act 2

Some Surprising Good News On December 29, 2022, The SECURE ACT 2 become law and changed many items that can affect retirees, pre-retirees, and all American’s financial picture in fact. There is a...

Read more

7 Tips That May Help to Increase Your Retirement Savings

Many retirees, unfortunately, are ill-prepared to actually retire. In fact, about 37% of retirees in 2022 said that they didn’t have enough money to enjoy their golden years. There are several...

Read more

New Century Planning at Power of Zero Conference

Receives Updated Information for Clients’ Retirement Planning Needs New Century Planning President Robert M. Ryerson had an opportunity to discuss the latest trends in retirement planning with Best...

Read more

Navigating the Peaks of Retirement: Understanding the 5 Essential Pillars of Retirement Planning

Retirement planning is often compared to climbing a financial mountain, and rightly so. It involves meticulous preparation, awareness of potential pitfalls, and a strategy that sees you through...

Read more

Resolutions You Need to Change Your Finances in 2023

A new year is a time for people to reflect on new resolutions and changes they want to make, and finances are no exception. Nearly 97 million Americans have plans to make a resolution in the year...

Read more

4 Financial Planning Moves You Need to Make before the Year Ends

As 2022 draws to a close, now is the time to start considering what financial moves you will want to make before the end of the year and the start of 2023. This aspect of financial planning is...

Read more

Ryerson Co-Producer of Important Documentary

“I am honored and excited to be able to be a co-producer of this inspiring documentary about entrepreneurs who embraced their dreams instead of just having their heads in the clouds!” Robert M....

Read more

Is Crypto Innovative or Insidious? How and Why Countries Are Banning Cryptocurrency

Cryptocurrency has been experiencing surges of usage and popularity in mainstream digital media in the United States. However, the digital currency exchange is being curbed by the negative...

Read more

4 Ways You Can Protect Your Child’s Identity from Being Stolen

Note: I cannot guarantee the accuracy of any of any of these quotes or articles or projections—these are just recent subjects and events and questions and rumors that have piqued my interest, and...

Read more

Here Are 7 of the Most Common Mistakes Made When Estate Planning

As 2022 draws to a close, now is the time to start considering what financial moves you will want to make before the end of the year and the start of 2023. This aspect of financial planning is...

Read more

6 Types of Retirement Accounts to Know About

Many people don’t start saving for retirement until it’s too late. And, a lot of the time, that’s because they don’t know the first thing about finding a good retirement plan. To make sure you don...

Read more

CHAOS UPON US? – Saturday evening October 15th, 2022

Note: I cannot guarantee the accuracy of any of any of these quotes or articles or projections—these are just recent subjects and events and questions and rumors that have piqued my interest, and...

Read more

Retirement Dos and Don’ts: 6 Important Planning Tips for the Future

Retirement planning was as difficult as ever in 2022. The S&P 500 was down more than 23 percent by October, since the start of the year and inflation was at 8.3 percent in August. For comparison,...

Read more

This Is How to Avoid Problems When Passing Digital Assets to Your Heirs

(Passing digital assets to heirs can be unnecessarily complicated and time consuming unless you do some of the legwork upfront) Not long ago, digital assets played virtually no role in estate...

Read more

Robert M. Ryerson and Louis R. Terrero of New Century Planning Associates Earn The NSSA® Advisor Certification

New Century Planning Associates, Inc. is proud to announce that Robert M. Ryerson RICP and Louis R. Terrero CPA, have received the prestigious National Social Security Advisor certificate from the...

Read more

5 Reasons Why It’s Helpful to Keep Working in Retirement

In large part due to inflation and market volatility, the retirement landscape in the United States has changed considerably in the last year or two. According to Franklin Templeton Investments’...

Read more

New Century Planning Associates Now Has A Retirement Income Certified Professional (RICP) available to help clients.

New Century Planning Associates, Inc. is proud to announce that its president, Robert M. Ryerson, has received the prestigious Retirement Income Certified Professional designation. This designation...

Read more

5 Important Questions You Need to Ask Yourself When Planning Your Retirement

Planning for retirement can be a stressful and overwhelming experience, especially with rising prices due to inflation. According to data from the Natixis Global Retirement Index in 2021, 36...

Read more

The Importance of Retirement Planning: Reasons to Start Right Now

Good financial stewardship involves paying off debt and saving for the future, the latter of which is especially important considering the average retirement age in the United States is 65 and 63...

Read more

10 Great Tips for Planning for Retirement

Retirement doesn’t just happen. It requires careful planning and commitment to make sure you have the financial stability needed to support yourself into your golden years. If you’re thinking about...

Read more

BLOG SERIES – COMBATTING INFLATION. A Couple of Easy, Small Ways to Combat Inflation

1. I-Bonds are paying 9.625%! As of 5/1/22, the yield on the treasury’s i-Bonds has moved up to 9.625% – a level we have not seen in a long time. These bonds can be purchased at www.treasurydirect...

Read more

10 Things to Know before Investing in Bitcoin

Lately, Bitcoin (BTC) has been noteworthy in the world of finance, because it has fallen roughly 68% from its all-time high of $68,000 on November 10th, 2021, to the $20-21,000 level currently....

Read more

Top 10 Questions About Relocating to Ecuador

Ed. Note:One fundamental investment recommendation you have seen many times is the wise diversification of assets, that is, not risking all your retirement eggs in one type of investment. Now,...

Read more

JUNE 2022 – Seminars. IS YOUR RETIREMENT PLAN READY FOR 2022 AND BEYOND?

Learn How Global Events, Increasing Inflation, and a Volatile Stock Market Could Affect Your Retirement Important Educational Topics we’ll discuss: ✓How to survive a lost decade or market crash.✓...

Read more

What You Should Know about Digital Assets in the Estate Planning Process

In this increasingly online world, people do not look at their digital assets in the same way they do their physical assets. However, everything from domain names to social media accounts can be...

Read more

4 Identity Theft and Fraud Scams That Consumers Need to Know

Identity theft, which involves stealing another individual’s personal information, has become an increasingly pervasive problem in recent years due in part to advances in technology. There are now...

Read more

With Inflation at 8.5%, The Sterling Case for Silver

Spot Silver $22.54 – 5/03/22 A quick look at the price of silver today leads one to believe that it is about $25 per ounce, which is roughly half of what it was in the spring of 2011. (Silver...

Read more

APRIL 2022 – Seminars. 19th and 21st at 6:30 p.m.

IS YOUR RETIREMENT PLAN READY FOR 2022 AND BEYOND? Learn how covid-19, increasing inflation, and a volatile stock market could affect your retirement Important Educational Topics we’ll discuss:...

Read more

MAY 2022 – Seminars. 10th and 12th at 6:30 p.m.

IS YOUR RETIREMENT PLANNING READY FOR THIS YEAR AND BEYOND? Learn how covid-19, increasing inflation, and a volatile stock market could affect your retirement Important Educational Topics we’ll...

Read more

A Step-by-Step Guide to Retirement Planning

Many people fail to think about their retirement until their 40s or 50s. However, this is a mistake. Putting off retirement planning can force you to postpone your retirement, sell your home and...

Read more

12 Fascinating Facts about Bitcoin

A new year is a time for people to reflect on new resolutions and changes they want to make, and finances are no exception. Nearly 97 million Americans have plans to make a resolution in the year...

Read more

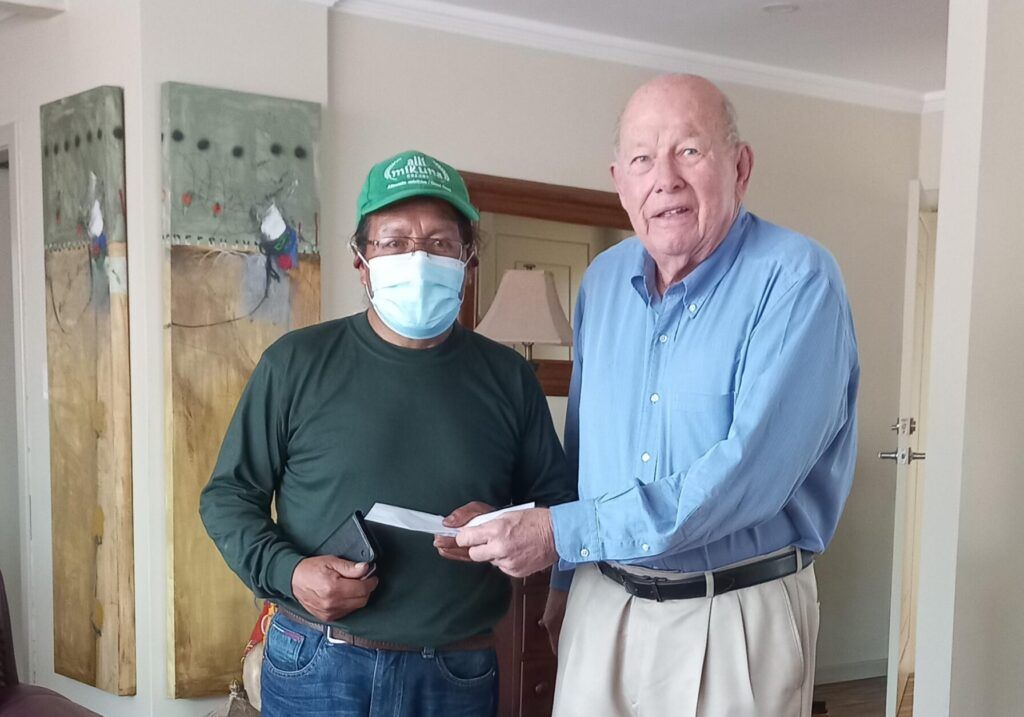

CHRISTMAS GIFT FROM NEW CENTURY PLANNING

New Century Panning -Ecuador donated a Christmas gift to help the less fortunate families of Canar. Cuenca Expats Magazine’s Managing Partner Ed Lindquist was honored to present the gift on behalf...

Read more

January 2022 – Seminars

IS YOUR RETIREMENT PLANNING READY FOR 2022 AND BEYOND? Vincent’s Italian Restaurant Tuesday, January 18, 2022 – 6:30 pm. Thursday, January 20, 2022 – 6:30 pm. Previous Next Address 350 Mounts...

Read more

February 2022 – Seminars

IS YOUR RETIREMENT PLAN READY FOR 2022 AND BEYOND? Learn how covid-19, increasing inflation, and a volatile stock market could affect your retirement Important Educational Topics we’ll discuss:...

Read more

COVER STORY – Expats, it’s time for a financial check-up!

The post COVER STORY – Expats, it’s time for a financial check-up! first appeared on New Century Planning...

Read more

Tips to Help You Prepare for Retirement

When you are in the prime of your life, retirement may seem like a long way off in the future. Maybe this perception is the reason why 60 percent of Americans haven’t determined how much they’ll...

Read more

How Do Cryptocurrencies Work, and What is the Impact of the China Ban?

On September 24, 2021, China’s central bank issued a statement explaining that all virtual currency-related business activities were illegal from that moment on in the country, effectively placing...

Read more

5 Financial Tasks to Take Care of the Year before You Retire

As you enter the last year before your retirement, it’s tempting to assume that all the retirement planning work you need to do is already done. After all, you’ve hopefully been able to spend...

Read more

What You Need to Know about the 4 Financial Stages of Retirement

Most of the general information you’ll find on retirement planning treats retirement as if it were a single, unchanging phase that begins when you stop working and lasts for the rest of your life....

Read more

September 2021 – Seminars

Vincent’s Italian Restaurant Tuesday, September 14 and Thursday, September 16, 2021 – 6:30 pm. Previous Next Address 350 Mounts Corner Dr Freehold, NJ 07728 What You...

Read more

October 2021 – Seminars

Colts Neck Inn Tuesday, October 5, 2021 and Thursday, October 7, 2021 – 6:30 pm. Previous Next Address 6 Route 537 W, Colts Neck, NJ 07722 Contact Us Phone: +1-732-702-2777 / +1-844-921-2400. Email...

Read more

6 Big Myths about Cryptocurrencies You Shouldn’t Believe

In the world of cryptocurrencies, it can be difficult to separate fact from fiction. As Bitcoin and other digital currencies have grown exponentially over the past decade, so too have the myths...

Read more

New Century Goes International

Over 9 million US citizens living overseas. Even though they are now “expats” most still need sound financial advice that can maintain their income streams, manage their tax liabilities and address...

Read more

August 2021 – Seminar

NEW CENTURY PLANNING OF ECUADOR WELCOMES YOU! Why you need to add precious metals & cryptocurrencies to your portfolio Sunrise Cafe Dinner will be served at 6 pm! Make your reservation! CEL.:...

Read more

July 2021 – Seminars

“DON’T WORRY, RETIRE HAPPY” With Tom Hegna THE CRITICAL 7 STEPS TO RETIREMENT SECURITY Battleground Country Club LUNCH: Wednesday, July 21, 2021 – 12:00 PM. DINNER: Wednesday, July 21, 2021 – 6:00...

Read more

Retirement Planning: Don’t Forget These 6 Important Expenses

Planning for retirement is an important financial consideration that should be initiated as soon as possible. (However, it’s never too late to start the process.) A general rule of thumb...

Read more

Get Answers to 6 of Your Most Important 401(k) Questions

401(k) plans are hailed by many financial experts as one of the easiest and most convenient ways to save for retirement. However, according to data from the US Census Bureau, although an estimated...

Read more

A Helpful Cryptocurrency Glossary That’s Great for Beginners

I recently did a webinar with a colleague on the subject of learning about Bitcoin and cryptos. An Introduction to Crypto-Currencies Hosted by Robert Ryerson, Dr. Jose Cao Alvira, Nikki Shank....

Read more

6 Signs That Can Tell You if You’re Financially Ready to Retire

Do you find yourself thinking about retirement with just as much fear as excitement? If so, it’s not at all surprising; workplaces seem to be full of stories about people who stop working too soon...

Read more

5 Retirement Mistakes You Absolutely Need to Avoid

The amount of money needed for retirement depends on factors including lifestyle, age, and health. Generally, experts suggest that individuals should aim to live off of 80 percent of their final...

Read more

Are Multiple Financial Advisors a Smart Idea? What You Need to Know

Working with a financial advisor to help you achieve your financial goals has become increasingly common. Where once people considered financial advisors and financial planning in general only...

Read more

Getting Started with Cryptocurrencies – 7 Big Questions Answered

The post Getting Started with Cryptocurrencies – 7 Big Questions Answered first appeared on New Century...

Read more

5 Reasons Why Retirement Planning Matters More Than Ever

If you’re finding it difficult to make retirement planning a priority, you’re not alone. Meeting your current financial obligations—such as rent or mortgage payments, recurring monthly expenses,...

Read more

How Can A Financial Professional Help You?

Today, the field of financial planning is growing in popularity, with more people than ever working to create some type of financial plan for their future. For those who possess little...

Read more

What Is Dogecoin? Understanding the “Joke” Cryptocurrency

The cryptocurrency market is perhaps one of the most volatile and unusual investment opportunities in existence today. From the original Bitcoin came hundreds of other cryptocurrencies of all types...

Read more

Spotlight: 5 of the Best Designations for Retirement Planners

When looking for wealth management assistance and guidance, you should first make sure any prospective advisors have qualified and respected professional designations. Because the financial...

Read more

How to Choose a Life Insurance Policy

Retirement planning covers a variety of different areas, from 401(k) plans to estate planning. Navigating this complex area on your own can be a challenge, so it is beneficial to seek out the...

Read more

RMDs And Your Retirement: How Will You Be Affected?

For most Americans, large portions of their money sit in retirement accounts without a second thought. Few even consider those funds again until they begin to approach retirement age. One often...

Read more

Important Steps in the Retirement Planning Process

Planning for retirement is an important part of securing your financial future. But many people either do not have any sort of plan at all, or are simply not doing enough to ensure their financial...

Read more

Financial Planning Mistakes You Need to Avoid

Establishing a stable financial future is a common goal, but it’s hard to know if you are doing things right. You might wonder whether or not you even need a financial planner, or you may think...

Read more

Spotlight – Retirement Planning by the Decade

Retirement savings are important for everyone, no matter what their age. The earlier that you begin putting money away for retirement, the greater the chances are that you’ll be able to live the...

Read more

New to Cryptocurrency? Here’s What You Need to Know

Though a recent innovation, cryptocurrency has certainly taken the world by storm over the last several years. Originally introduced around 2009 with bitcoin, it did not at first attract...

Read more

5 Financial Steps You Need to Take during a Recession

Recessions are a way of life when it comes to both local and global economies. The volatile nature of the stock market and other investments combined with the way world events affect economic...

Read more

A Look at the Top Benefits of a Financial Plan

For many people, creating a financial plan is not a top priority, particularly when they’re young. Quite often, people don’t consider a financial plan until they begin to approach retirement age, a...

Read more

Understanding the Risks and Benefits of Cryptocurrency

Cryptocurrency has been around for approximately 11 years now when Bitcoin first hit the scene, and though the initial boom of excitement has faded somewhat, it remains a popular investment choice...

Read more

4 Easy Steps You Need to Know to Save for Retirement

Retirement planning is a long process, and it can be intimidating for many people. The vast majority of workers, in fact, have not taken even the most basic first steps to begin planning for their...

Read more

Why You Need to Continue Financial Planning after You Retire

When people consider their finances, the most common things they focus on are saving for retirement, maximizing their current finances, saving for major purchases, and paying down debt. But there...

Read more

5 Mistakes to Avoid When Planning for Retirement

Investing can sometimes appear to be a daunting task that many Americans would rather not attempt. In fact, only about 55% of Americans have actually invested in the stock market, and that number...

Read more

Financial Planning for Major Life Events: What You Need to Know

For many people, financial planning may not appear to be an absolute necessity. However, anyone can benefit from a bit of financial planning to improve their finances, particularly in terms of...

Read more

Important Aspects of Retirement Planning You Need to Know

As the average life expectancy in the United States grows, retirement planning should change along with it. For most people, retirement will last for several decades beyond what used to be common....

Read more

Cryptocurrency Debit Cards: What You Need to Know

The cryptocurrency industry has grown rapidly over the past several years, and the idea of digital currencies is becoming an accepted part of the financial mainstream. More people than ever have...

Read more

A Look at Financial Planning for a Recession: How to Survive

In times of economic uncertainty, you might wonder how best to plan for your financial future. Where should you be investing your money, and what types of strategies will serve you best to help you...

Read more

A Look at the Evolution of Cryptocurrency

Recently, cryptocurrency has moved into the spotlight. Nearly everyone has heard of cryptocurrency at this point, and many have developed an understanding of some of the aspects of how it works....

Read more

What You Need to Know about the First Meeting with Your Financial Planner

When it comes to your finances, there is a significant amount of planning involved if you want to meet long-term financial goals. It is for this and other reasons that many people choose to work...

Read more

A Look at Cryptocurrency as an Investment

Cryptocurrency is swiftly becoming a well-known aspect of our daily lives. Many people expect that it will only become more ubiquitous in the future, potentially evolving into a viable “digital...

Read more

Steps in the Financial Planning Process: What You Need to Know

We spend a lot of our lives planning, from trips and vacations to how to decorate the living room. But there’s one area you should be focusing on if you haven’t already, especially if you want a...

Read more

Self Employed? You Need to Know about Your Retirement Advantage

When it comes to retirement, most Americans today have some form of defined-contribution plan for their retirement, typically through their employer. The most popular retirement plan today is...

Read more

What You Need to Know about Retirement Planning Options

Even if you are young and not currently thinking about retirement planning, know that you should be. Research shows that the earlier you can start saving for your retirement, the better off you...

Read more

Questions You Need to Ask Your Financial Planner

Though many people view a financial planner as a luxury only necessary for the extremely wealthy, the truth is that a financial planner can help almost anyone achieve their financial goals and grow...

Read more

Important Points You Should Know about Roth IRAs

Nowadays, most people cannot count on Social Security to provide enough income during their retirement years. They will need to think strategically about the types of accounts they will need once...

Read more

Getting Started with Financial Planning, No Matter How Much Money You Have

Though many people consider financial planning as something only necessary for those with a substantial amount of wealth, the truth is that anyone can benefit from a good financial plan. Financial...

Read more

This Is What You Need to Know about Investment Risk in Retirement

When investing for retirement, risk tolerance generally changes over time. Individuals who are decades away from retirement typically accept a larger amount of risk for the chance to achieve...

Read more

6 Important Questions Your Financial Advisor Should Ask You

Despite recent reports that just under half of all American adults can handle an unexpected expense of $1,000 or more, the majority choose not to seek outside financial help. In fact, only 17...

Read more

5 Things You Should Know Before Retirement

Planning for retirement can prove extremely stressful, as individuals are forced to prediction how much they will need in retirement. Even when individuals save proactively and create a detailed...

Read more

Due Diligence – A KeyAspect to Succeed in Cryptocurrency Investing

As a reflection of his decades of experience as a retirement and financial planner, Robert M. Ryerson has shared his expertise in personal finance and economic trends through his involvement with...

Read more

Introduction to the Mind Your Own Business Act

In addition to his notable work in retirement planning and financial literacy education, Robert M. Ryerson is experienced in identifying theft and protection. Robert M. Ryerson is the author of the...

Read more

Top Four Cryptocurrencies in the World

Freehold, New Jersey resident Robert M. Ryerson is a Certified Financial Planner at New Century Planning. Knowledgeable on various investments including alternative assets like cryptocurrencies,...

Read more

Robert Ryerson to Fox Business: New Privacy Legislation “Much Needed”

Robert M Ryerson is a Retirement Income Certified Professional (RICP) and author of “What’s the Deal with Identity Theft – A Plain English Look at Our Fastest Growing Crime.” Robert M Ryerson...

Read more

Converting 401(k)s and IRAs to Roth Status Can Save Tax Dollars

Robert M. Ryerson has worked as a Certified Financial Planner since 1991. On a mission to help America’s workers secure their financial freedom during retirement, Robert M. Ryerson educates people...

Read more

Why Children Are Vulnerable to Identity Theft

Certified Financial Planner (CFP) Robert Ryerson of New Century Planning possesses more than 25 years of experience in estate management and retirement planning. Additionally, Robert Ryerson is a...

Read more

Difference Between Bitcoin and Bitcoin Cash

Robert M. Ryerson, with more than 25 years of experience, started Crypto Currency Consultants, LLC, in 2018. Financial experts like Robert M. Ryerson can help people navigate the challenges of...

Read more

Scenic Ecuador, beyond the Galapagos Islands

In 1998, Robert M. Ryerson established New Century Planning Associates Inc., where he continues to serve as the New Jersey-based company’s president.He assists clients with a variety of estate,...

Read more

Cuenca, Ecuador – Home to UNESCO-Honored Historic Architecture

A Certified Financial Planner, Robert M. Ryerson serves as the president of New Century Planning Associates Inc. (NCP) in Freehold, New Jersey. He and his team provide a variety of services,...

Read more

Three Must-Do Activities in Cuenca, Ecuador

An accomplished professional in the financial services industry, Robert M. Ryerson brings three decades of experience to his role as President of New Century Planning in Freehold, New Jersey. A...

Read more

What is Cryptocurrency Mining?

Certified Financial Planner (CFP) Robert M. Ryerson, a graduate of Rutgers University and experienced in his field, has embraced cryptocurrency. Enthusiasts like Robert M. Ryerson have invested in...

Read more

Required Minimum Distributions – What They Are and How They Work

As president at New Century Planning in Freehold, New Jersey, and a financial strategist with The Society of Financial Awareness, Robert M. Ryerson draws on extensive experience with retirement...

Read more

Benefits of Paying off a Mortgage Early

The nonprofit organization hosts workshops to increase financial literacy among the general public and dispenses sound financial advice for achieving common financial goals, such as paying off...

Read more

Provisional Income and Retirement Planning

For more than two decades, Certified Financial Planner Robert M. Ryerson has worked with a team of tax, mortgage, and insurance professionals for the financial services firm New Century Planning....

Read more

Identity Theft Statistics

Robert M. Ryerson serves as a Certified Financial Planner with New Century Planning in Freehold, New Jersey. He has additionally earned certification from the nonprofit Institute of Consumer...

Read more

Basic Tips for Establishing a Debt Repayment Plan

Robert M. Ryerson is a certified financial planner (CFP) with New Century Planning in Freehold, New Jersey, and a financial strategist with The Society of Financial Awareness in San Diego,...

Read more

What Are Bitcoins?

Certified Financial Planner Robert M. Ryerson has published and spoken extensively on financial topics. One innovation which Robert M. Ryerson has taken an interest in is cryptocurrency, a form of...

Read more

Things to Consider Before Retiring in Another Country

An author and Certified Financial Planner, Robert M. Ryerson is a respected presence in the Freehold, New Jersey, community. Among his activities, Robert M. Ryerson teaches a comprehensive...

Read more

Health Care Companies Hard Hit by Data Breaches

Robert M. Ryerson serves as a Certified Financial Planner with New Century Planning in Freehold, New Jersey. He has additionally earned certification from the nonprofit Institute of Consumer...

Read more

Reports of Identity Theft, State by State

Robert M. Ryerson is the author of the book What’s the Deal with Identity Theft? A Plain English Look at Our Fastest Growing Crime. A Certified Financial Planner who serves with Freehold, New...

Read more

When to Visit Ecuador

Robert M. Ryerson, at New Century Planning in Freehold, New Jersey, provide clients with information and guidance about identity theft, retirement distribution planning, and estate planning....

Read more

Cryptocurrency Prices Spike in Response to BlackRock Involvement

A co-author of What You Don’t Know About Retirement Will Hurt You!, Robert M. Ryerson is a certified financial planner (CFP) and certified identity theft risk management specialist (CITRMS). In...

Read more

Essentials of Estate Planning

Economics graduate Robert M. Ryerson shares his knowledge and experience in the financial field by speaking, teaching, and writing about identity theft protection. Also an estate administrator,...

Read more

Tax Reform Brings Several Benefits to Small Businesses

An author and Certified Financial Planner, Robert M. Ryerson is a respected presence in the Freehold, New Jersey, community. Among his activities, Robert M. Ryerson teaches a comprehensive...

Read more

View more