The 7 Biggest Risks in Retirement

Risk #1. Longevity

This is the risk of living a long time- and possibly outliving your money or income. This is the number one concern cited in most recent retirement surveys – with reason. Living a long time in retirement makes it much more likely that you will run into all of the other risks below…

Risk #2. Market Crashes

Most retirees use mutual funds, or some stocks, bonds or real estate as investments and sources of income in retirement. The problem is, from time to time, there are crashes or severe downturns in the real estate and securities markets. These negative cycles are virtually inevitable over long time periods. The problem is, a crash or two in the earlier years of your retirement can really mess things up and have a devastating long-term effect. If you need to withdraw money to live on from accounts that have fallen sharply in value, it can be very difficult to ever recover from that- and sometimes you don’t, and you run out of money (see the retirement red zone section below)

Risk #4. Rate of Withdrawal Risk

This is the risk that your withdrawals from your retirement accounts exceed your net earnings in several years. If this happens too many times, your risk of running out of money increases dramatically. Historically, a 4% annual withdrawal rate was said to be a safe figure.

In 1994, William Bengen, a financial planner, proposed the 4% rule. States that you can’t withdraw more than 4% of your retirement assets per year. If you do, you’ll likely outlive your money.

What variables need to be considered before deciding on a withdrawal rate?

- Life expectancy?

- Likely rates of return?

- What is your asset mix of stocks vs. bonds?

- How young are you at retirement?

- Your sequence of returns?

- What is the inflation rate?

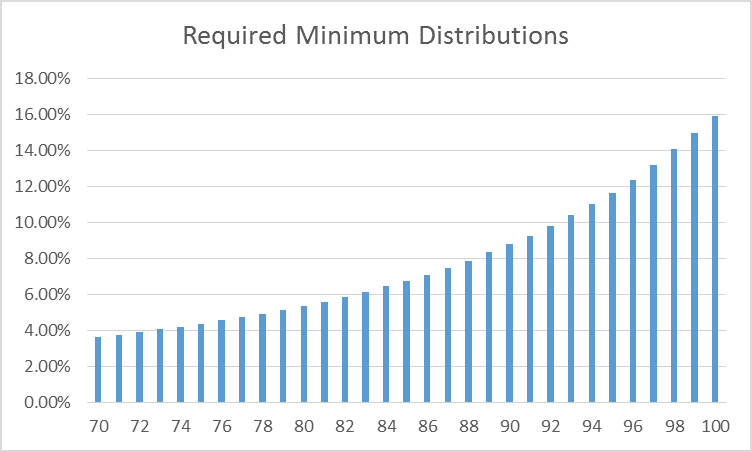

Life Expectancy

The younger you are at retirement, the less you should withdraw

- Retire at 70, you can likely take out 6 or 7%

- Retire at 62, that number falls to 2 or 3%Retire at 70, you can likely take out 6 or 7%

- So when do you plan on retiring?

Rates of Return

William Bengen’s theory is predicated on an average ROR of 8% for stocks and 6.6% for bonds

- Today, bonds average 2.4% or less

- Stock returns are projected to be lower than in the past 10-12 years

- In today’s environment a 4% withdrawal rate may be too aggressive.

Withdrawal Rates: Other Variables

- Tax rates?

- Social Security Income?

- Pension?

- Part-time work?

- Order of liquidation?

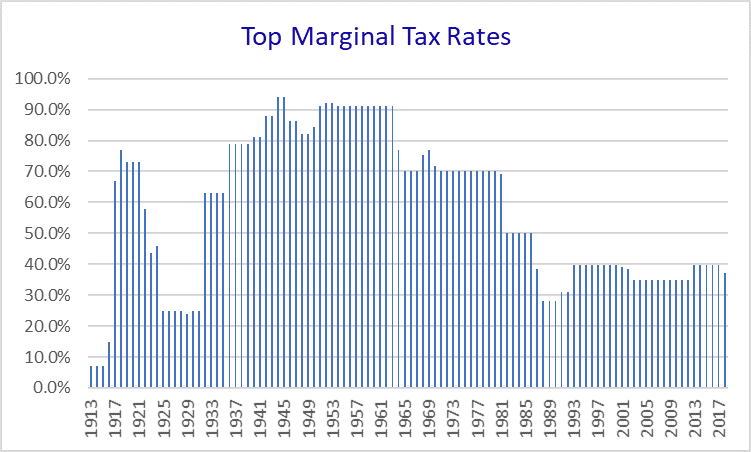

A History of Tax Rates

Tax rates are on sale right now- based on that history above

2017 Income Tax Rates and Brackets

| 2017 tax rate | Single | Married Filing Jointly |

|---|---|---|

| 10% | $0 to $9,325 | $0 to $18,650 |

| 15% | $9,325 to $37,950 | $18,650 to $75,900 |

| 25% | $37,950 to $91,900 | $75,900 to $153,100 |

| 28% | $91,900 to $191,650 | $153,100 to $233,350 |

| 33% | $191,650 to $416,700 | $233,350 to $416,700 |

| 35% | $416,700 to $418,400 | $416,700 to $470,700 |

| 39.60% | Over $418,400 | Over $470,700 |

2022 Income Tax Rates and Brackets

The 2017 tax act changed the tax rates and income ranges to which the rates apply.

| Tax Rate | Single | Married Filing Jointly |

|---|---|---|

| 10% | $0 to $10,275 | $0 to $20,550 |

| 12% | $10,275 to $41,775 | $20,550 to $83,550 |

| 22% | $41,775 to $89,075 | $83,550 to $178,150 |

| 24% | $89,075 to $170,050 | $178,150 to $340, 100 |

| 32% | $170,050 to $215,950 | $340, 100 to $431,900 |

| 35% | $215,950 to $539,900 | $431,900 to $647,850 |

| 37% | Over $539,900 | Over $628,301 |

2022 Standard Deductions

| Filing Status | Deduction Amount | |

|---|---|---|

| Single | $12,950 + $1,750 over 65 = | $14,700 |

| Married Filing Jointly | $25,900 + $1,400 (each) over 65 = | $28,700 |

| Head of Household | $19,400 |

Did you know?

…. That every dollar that comes out of your 401K, or 403K, or 457 plans, or IRA, or SEP, or Inherited IRA is fully taxable as ordinary income!

That’s right – even if you have held a stock or a mutual fund in your IRA or 401K for a very long time, and have very big gains on it, you will NOT receive the more favorable capital gains tax treatment when you take all or any of that money out. It doesn’t matter if the money coming out of your IRA is a gain, a loss, interest, or dividends – it is all taxed as ordinary income!

Risk #7. Long Term Care – Chronic Illness

Click

here for our entire Long Term Care section. Contact us – start your planning now!