The Problem with Large 401Ks/IRAs

While it is a great “problem” to have a large amount of money accumulated in a tax-deferred retirement account such as a 401K or IRA, it is a problem nonetheless in the sense that all of that money is NOT yours – because it has not been taxed yet. A certain portion of that big tax-deferred number will go to the taxing authorities when you take the money out, and we do not know how much that portion will be – 15%, 25%, 40%?

It is hard to plan accurately for retirement, and especially retirement income and taxes, when you don’t know how much money you’ll actually have in those accounts. This leads us to the compelling planning idea of ROTH conversions…

Common Questions

Why is a Roth Conversion So Powerful?

- Right now, and up until 12/31/25, tax rates are on sale! From an historic standpoint, tax rates are quite low for the next 4 years, so shifting money through Roth Conversions is a smart move.

- Once you convert to Roth, that money is never taxed again! It is tax free for you, and for your beneficiaries!

- Unlike a Roth Contribution, which is limited to $7000 per year, a Roth Conversion can move much larger amounts of money (50k? 100k? 200k?) to the forever tax free world of the Roth.

- If you convert substantial amounts of money to Roth status over several years, you can create a significant stream of tax-free income- often for life. This tax-free income, and all the money in the Roth accounts, is insulated from any tax increases that may come down the road.

- Not only are your income streams or withdrawals tax-free, but so is all the growth in the account. For this reason, we often encourage clients to convert the assets with the most perceived upside potential. For example, this can include silver, cryptos, aggressive growth stocks, etc.

What is the 5 Year Rule with Roth IRA’s?

- Earnings on your contributions (and you must be age 59 ½ or older to avoid a 10% penalty).

- If you convert funds to ROTH status, from an IRA or 401k or 403b, etc., you need to wait 5 years in order to withdraw your growth on those funds tax free. However, you can withdraw your converted principal at time after the conversion-there is no 5 year waiting period. For example, if you are 60 years old, and you convert $100,000 of your IRA or older 401K to ROTH status, all of that $100,000 will be added to your taxable income for that tax year.

- If you inherit a Roth IRA, and the owner did not hold the Roth for more than 5 tax years.

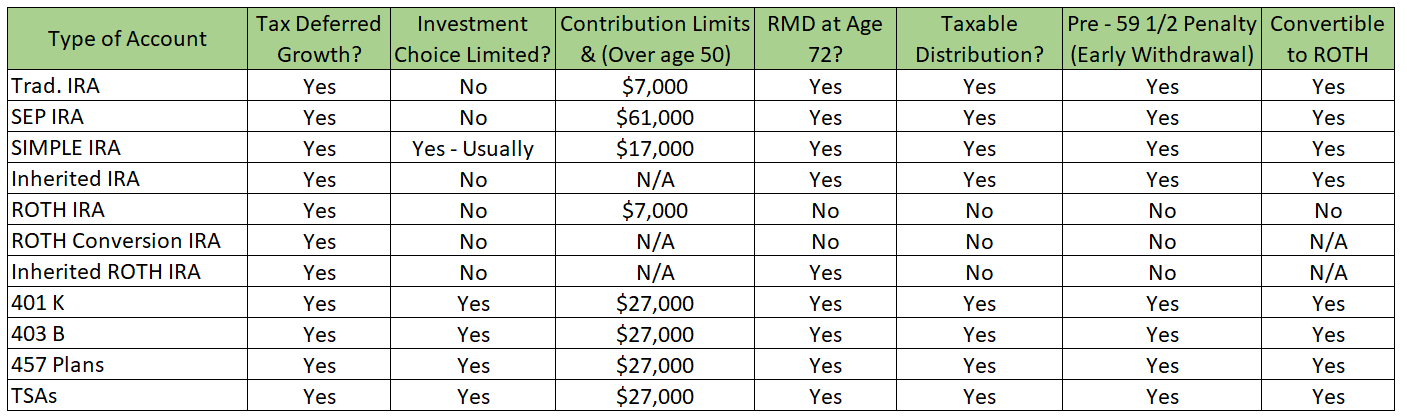

What are different types of IRA accounts?

Traditional IRAs

Inherited IRAs

Rollover IRAs

ROTH IRAs

SEP IRAs

Conversions ROTH IRAs

Simple IRAs

Inherited ROTH IRAs

What are the different rules for each IRA?